EU Emissions Trading System – an introduction

As part of European Union’s (EU) efforts to reduce emissions from the bloc’s various industries, from January 2024 the European Union Emissions Trading System (EU ETS), will now include shipping.

What is the EU ETS?

The EU ETS was first introduced in 2005, with the funds generated going to support member states’ investments in renewable energy, energy efficiency measures and technologies that can help reduce emissions.

The ETS works on the cap-and-trade principle. A cap is set on the total amount of greenhouse gases that can be emitted by the various industries covered by the system. This cap is reduced annually in line with the EU’s climate targets, a 55% reduction in GHG emissions by 2030 relative to 1990, and net zero by 2050.

The cap is expressed in emission allowances (EUAs), where one allowance gives the right to emit one tonne of CO2eq (carbon dioxide equivalent). Each year companies must provide enough allowances to fully account for their emissions, or risk receiving heavy fines. These allowances can be bought on the EU carbon market, or companies can trade allowances with each other if needed.

What are the implications for us?

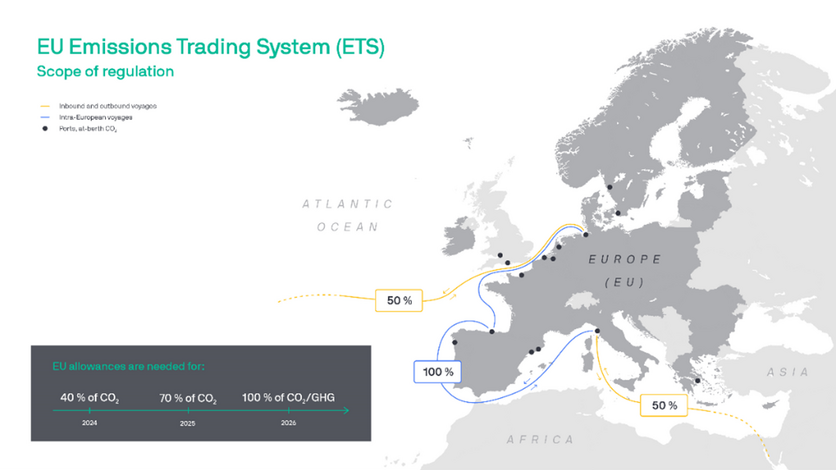

From 1 January 2024 there will be a three-year phase-in period, with the cap increasing in scope from 40% of emissions in 2024 to 70% in 2025 and 100% in 2026, and for each year thereafter.

In terms of geographical reach, the scope of the ETS for shipping includes 100% of emissions on voyages and during port calls within the EU/EEA (European Economic Area), and 50% of emissions on voyages into or out of the EU/EEA.

EUKOR will have to purchase emission permits, or ‘EU allowances’ (EUAs) in the market corresponding to its emissions.

What does this mean for you?

Effective from 1 January 2024, EUKOR will introduce new trade-lane based EU ETS surcharges on all cargo shipped on our vessels or with third party carriers on all voyages into or out of the EU/EEA, including the United Kingdom. Although the UK is now not part of EU ETS, cargoes in and out of UK are always co-loaded with EU cargoes on all voyages in and out of EU, therefore we apply the EU ETS Surcharge to all cargoes to/from UK and EU.

Similar to our bunker surcharge, the EU ETS surcharge will be reviewed quarterly and will change in line with the price evolution of EUAs over the previous 3 months. For 2024, we will use baseline data for our CO2 emissions and cargo volumes shipped into or out of the EU/EEA including the United Kingdom during 2022.

If you’d like to learn more about our shipping segment or have specific questions regarding our ETS surcharge, please contact your local sales representative.